The Account Inquiry component contains a number of pages that enable you to view details regarding your account, make payments, view tax forms, and set up a payment plan.

Table of Contents

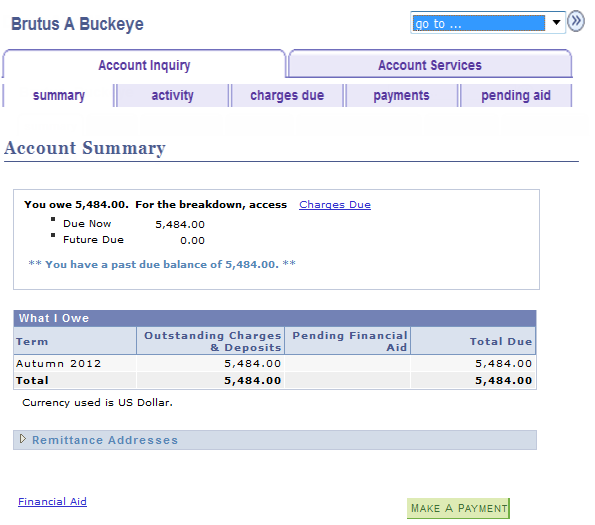

Account Summary

- The Account Summary page displays the balance of charges due now, future charges due and any past due charges.

- You can get a more complete view of any charges by selecting Charges Due. This takes you to the Charges Due page.

- You can view the Remittance Address for the Bursar's office by expanding the Remittance Addresses drop-down menu.

- You can view any Financial Aid information by selecting Financial Aid.

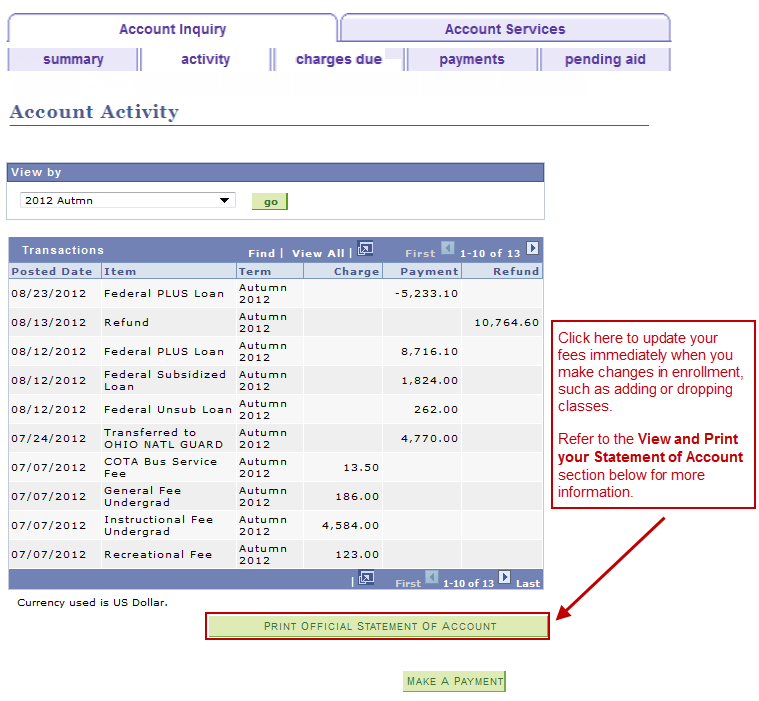

Account Activity

- View and print a Statement of Account

- View account activity for all terms or one specific term

- Make an online payment (select

to jump to the Make a Payment page)

to jump to the Make a Payment page)

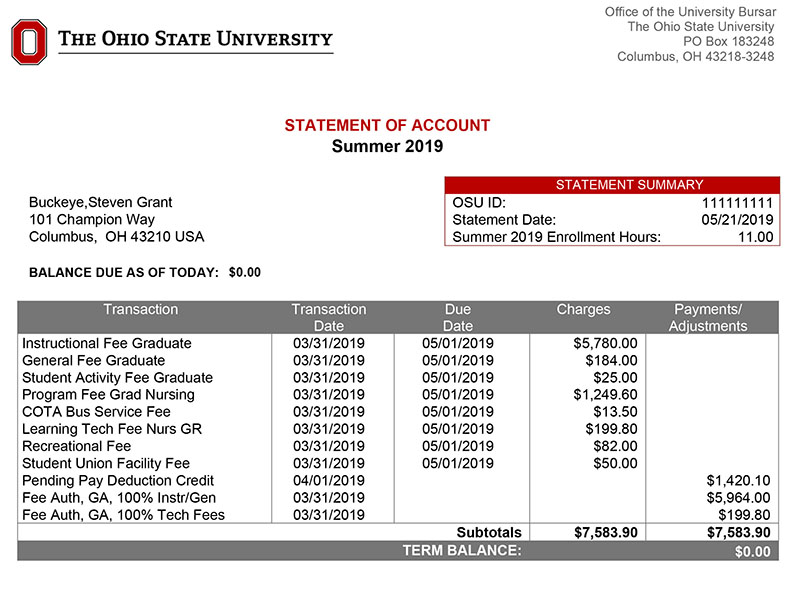

View and Print Your Statement of Account

1. If you wish to view your Statement of Account for the current term, skip to step 2. However, if you wish to view your Statement of Account for a different term:

a. Select the View by menu.

b. Select the desired term.

c. Select

2. Select Print Official Statement of Account .

- The Statement of Account opens as a .pdf formatted file. You can print it to enclose with your payment.

- Clicking this button also recalculates your fees and updates your Account Summary information.

- See Understanding Your Statement of Account for more information.

3. Select

- You should return to the Account Activity page.

- You may have to refresh this page to display updated fees; either click your browser's Refresh button, or navigate to another page on your Student Center and then return to the Account Activity page.

View account activity by a specific term:

- Select the View by menu.

- Select the desired term.

- Click

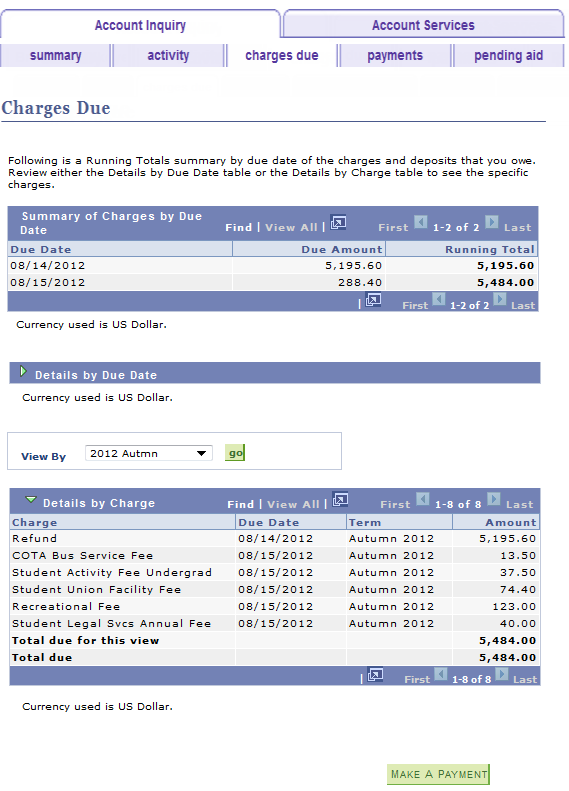

Charges Due

- On the Charges Due page, you can view a Summary of Charges by Due Date, Details by Due Date, Details by Charge and Make an Online Payment.

- You can also find your payment plan installment schedule on the Charges Due page.

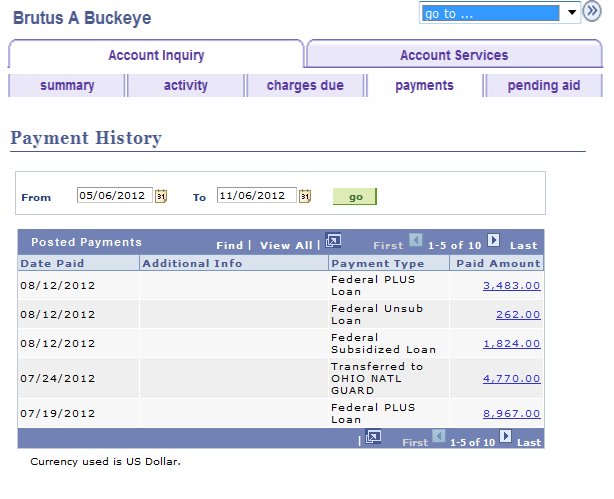

Payments

- On the Payments page, you can view the payment history on your account. This page displays all posted payments as well as any pending payments.

- You can select a specific date range by selecting the desired dates and selecting

.

.

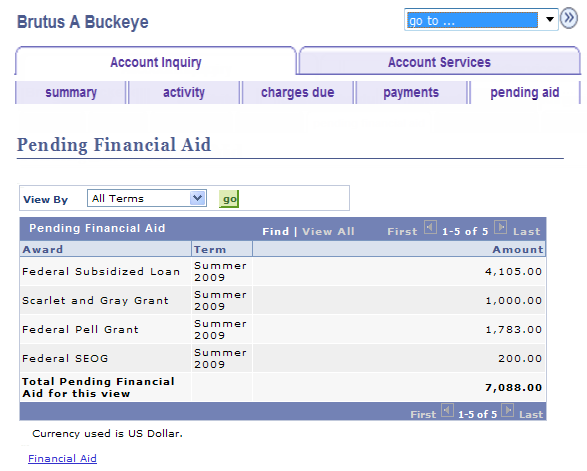

Pending Financial Aid

- The Pending Financial Aid page displays financial aid that has been awarded to you early, in anticipation of the actual receipt of financial aid funds.

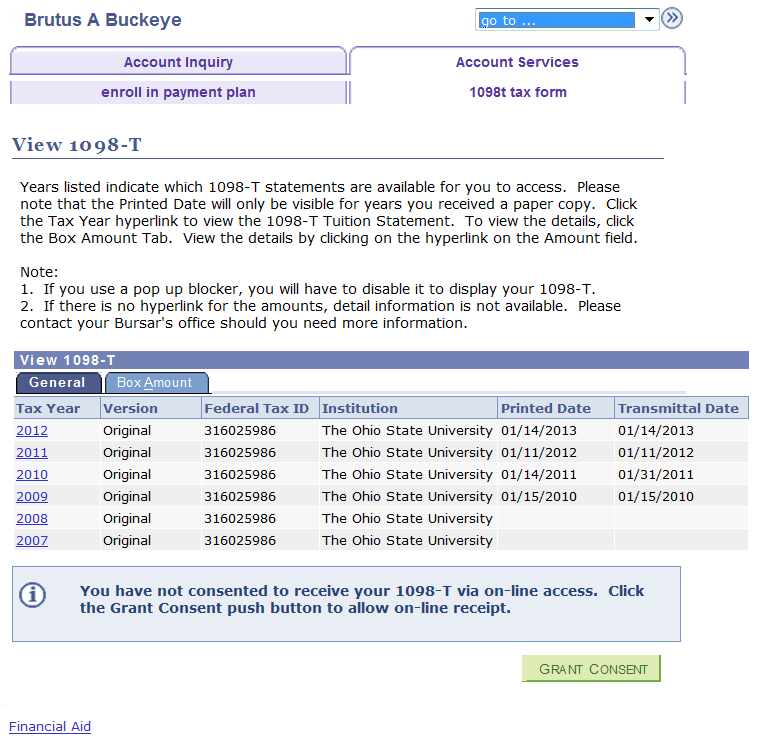

1098t-tax form

Students can view and print the 1098-Tforms for tax filing purposes.

Universities are required to report this information to students to assist with the Hope and Lifetime Learning tax credit which may be utilized when filing an annual Individual Income Tax Return Form to the IRS. OSU staff are not tax professionals and cannot provide advice on completing a tax return form, the use of the information provided on the 1098T form, or provide services to compute tax credits.

In order to receive a paper copy, students must complete the following steps:

- Complete Consent Agreement.

- Submit Consent Agreement.

Once the Consent Agreement has been submitted, students can view 1098-T forms for applicable years in .pdf formatted files.

A printed 1098-T will be sent to eligible students via U.S. Mail.

It is imperative that eligible students have a valid address and SSN in the system in order to generate a 1098-T for their account.

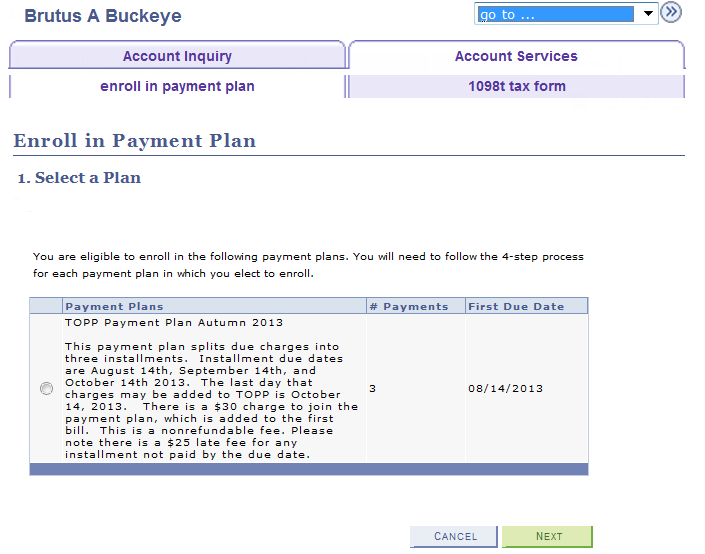

Payment Plan (TOPP)

The Payment Plan page allows you to enroll in the Tuition Option Payment Plan (TOPP). For additional details about TOPP, including a step-by-step instruction guide for how to enroll, visit the Enroll in Tuition Option Payment Plan job aid.

Last modified: Nov 17, 2020